Despite annual threats to Medicare’s physician payment rate, primary care physicians will benefit from the implementation of a new code for visit complexity, among other key changes.

Fam Pract Manag. 2024;31(1):25-31

Author disclosures: no relevant financial relationships.

Editor's note: This article was updated 1/23/24 with additional information about codes G0136 and 99459. It was also updated 3/13/24 after Congress and President Biden reversed most of the scheduled Medicare pay cut.

Every year family physicians and their staffs are given the challenge of managing changes in coding and Medicare payment policy. While some years it may be easy to tell whether the changes as a whole benefit your practice financially, this year it’s complicated. Some policies will cut payments and others should boost revenue for family physicians.

It’s a complex picture, but this summary should give you an idea of what to expect for your practice in 2024.

KEY POINTS

A Medicare rate cut will hurt most physicians financially in 2024 unless Congress reverses it. But primary care doctors should have it at least partially offset by a new add-on code for visit complexity.

CPT made several changes to time-based evaluation and management coding to better align it with Medicare guidelines.

There are few substantive changes to Medicare’s Quality Payment Program in the new year, but there are still some steps practices can take to maximize the benefits of participation.

MEDICARE PAYMENT POLICY CHANGES

First, the bad news. At press time, the Centers for Medicare & Medicaid Services (CMS) had decreased the conversion factor — the amount Medicare pays per relative value unit (RVU) — from $33.89 in 2023 to $32.74 in 2024, barring a reversal by Congress at the 11th hour. (Editor's note: Congress and President Biden reversed most of this cut in March 2024.)

This 3.37% cut is due to partially expiring conversion factor relief and mandated budget neutrality adjustments. Any time Medicare physician payments are estimated to increase by $20 million or more (due to either coverage for new services or rate increases for services already covered), CMS is required to offset that with cuts.

In recent years, Congress has delayed those cuts with COVID-19 relief bills. Although the official COVID public health emergency ended in May, more than 100 medical groups, including the AAFP, urged lawmakers to delay the cuts again, noting that high inflation is increasing the cost of running a practice.1

The good news for family physicians is that CMS has agreed to finally start paying for code G2211 in 2024, after three years of delay.2 This is an add-on code for evaluation and management (E/M) codes 99202-99215 that is intended to compensate primary care physicians for the complexity of providing comprehensive care to their patients. When reported properly, the separately payable add-on code will add approximately $16.04 to the Medicare allowance for each E/M service.

Code G2211’s official description is “Visit complexity inherent to evaluation and management associated with medical care services that serve as the continuing focal point for all needed health care services and/or with medical care services that are part of ongoing care related to a patient’s single, serious condition or a complex condition.”

G2211 should apply to most E/M visits with new and established patients who have (or will have) an ongoing relationship with the physician for all needed health care, especially conditions such as heart failure, diabetes, chronic kidney disease, or a host of other complex health issues. There is one major restriction: Medicare will not pay for G2211 when reported in addition to an E/M code with modifier 25 (e.g., when you report an E/M service with a minor procedure on the same date).3 (For more information, see the FPM article "G2211: Simply Getting Paid for Complexity" and the AAFP page "G2211 Add-on Code: What It Is and When to Use It.")

Here are other Medicare changes pertinent to primary care.

Telehealth. CMS is adding code G0136 (“Administration of a standardized, evidence-based Social Determinants of Health Risk Assessment, 5–15 minutes”) to its telehealth services list on a permanent basis in 2024. Otherwise, the 2023 list will remain untouched. The agency is also maintaining many pandemic-era telehealth policies for 2024 (see “Medicare telehealth policies that remain in effect”).

MEDICARE TELEHEALTH POLICIES THAT REMAIN IN EFFECT

No in-person requirement for telehealth services for diagnosing, evaluating, or treating mental health disorders,

No originating site restrictions,

No telehealth frequency limitations for inpatient and nursing facility services and critical care consultation services,

Covering audio-only provision of services for everything on the Telehealth Services List as of Dec. 29, 2022,

Covering and paying for telephone E/M services (codes 99441-99443),

Allowing physicians to provide direct supervision of clinicians or staff through real-time audio and video interactive communications,

Allowing physicians to use their practice’s address when they provide telehealth services from home.

You’ll need to pay attention to the modifiers you use when reporting telehealth services to Medicare in 2024. Synchronous, audio-visual telehealth won’t require modifier 95 (the pre-pandemic modifier for that form of remote visit), but audio-only services, when permitted, will require modifier 93 (“Synchronous Telemedicine Service Rendered Via Telephone or Other Real-Time Interactive Audio-Only Telecommunications System”) and/or modifier FQ (“A telehealth service was furnished using real-time audio-only communication technology”).

You’ll also need to pay attention to the place of service (POS) codes you use, because they will impact Medicare payment. Key codes include:

POS 10 (telehealth provided in patient’s home),

POS 02 (telehealth provided other than in patient’s home).

Medicare will pay for POS 10 at the same rate as if the service had been done in your office, while POS 02 will be paid at the lower “facility setting” rate.

More POS code news. Speaking of POS codes, CMS created POS 27, “Outreach Site/Street,” which describes a “non-permanent location on the street or found environment, not described by any other POS code, where health professionals provide preventive, screening, diagnostic, and/or treatment services to unsheltered homeless individuals.” POS 27 was technically effective for dates of service on or after Oct. 1, 2023, but CMS gave its Medicare Administrative Contractors (MACs) until Jan. 2, 2024, to implement the change.4

Behavioral health. CMS is increasing the Medicare allowance for general behavioral health integration care management (CPT code 99484) to $54.03. This basic behavioral health service can be delivered by clinic staff working under the supervision of a physician or other qualified health care professional (QHP).5 If your practice doesn’t already offer this, it may now be more financially viable to do so.

Vaccine administration. CMS is renewing the additional payment for at-home COVID-19 vaccination and extending it to other Part-B covered vaccines (pneumococcal, influenza, and hepatitis B). The in-home additional payment is limited to once per visit even if multiple vaccines are administered, but a distinct administration payment will still be provided for each vaccine. If your practice offers home visits to Medicare patients, consider administering recommended vaccines during those visits to take advantage of the additional payment.

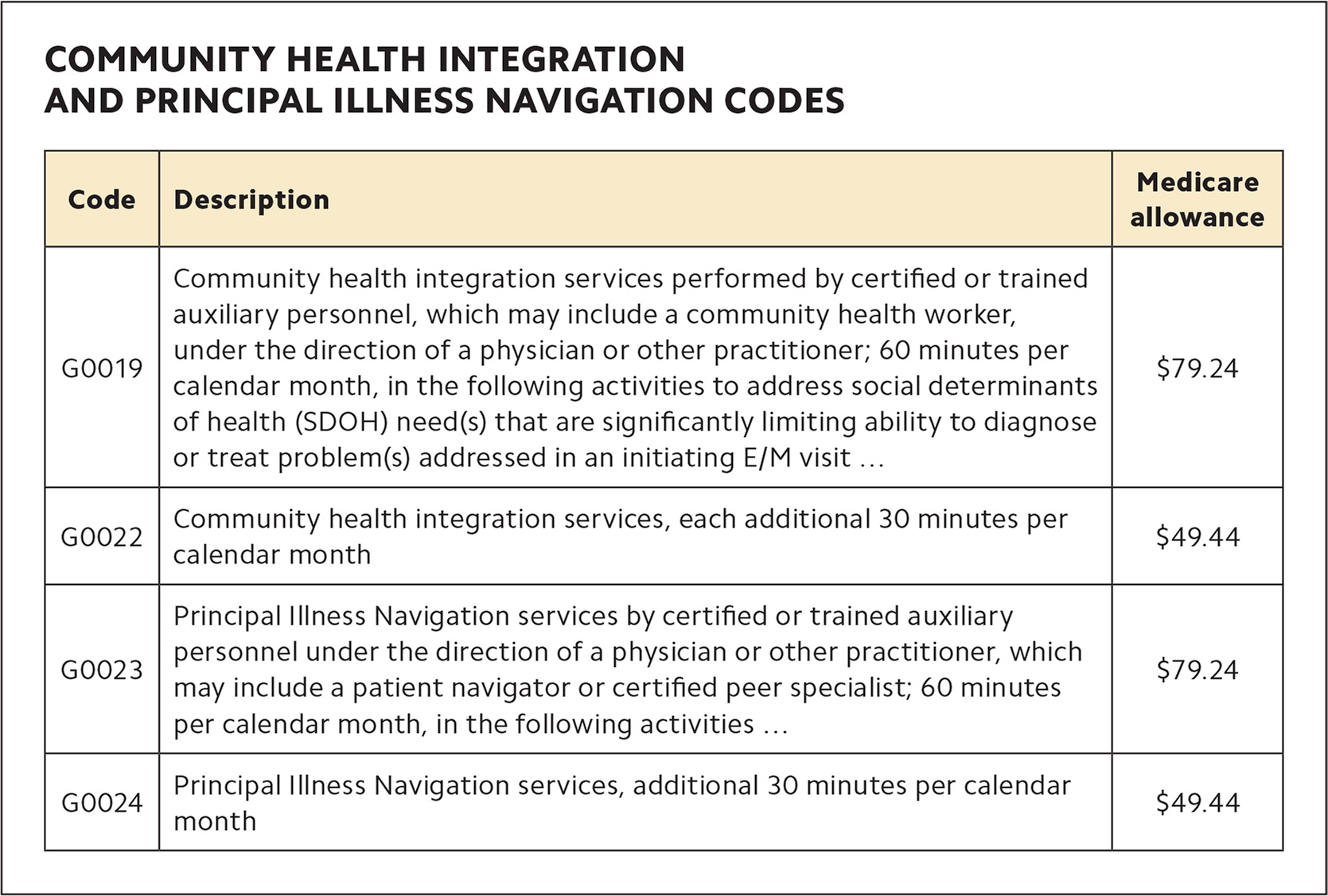

Community health integration and illness navigation services. CMS has created new codes for community health integration (CHI) services and principal illness navigation (PIN) services (see the list of codes).

| Code | Description | Medicare allowance |

|---|---|---|

| G0019 | Community health integration services performed by certified or trained auxiliary personnel, which may include a community health worker, under the direction of a physician or other practitioner; 60 minutes per calendar month, in the following activities to address social determinants of health (SDOH) need(s) that are significantly limiting ability to diagnose or treat problem(s) addressed in an initiating E/M visit … | $79.24 |

| G0022 | Community health integration services, each additional 30 minutes per calendar month | $49.44 |

| G0023 | Principal Illness Navigation services by certified or trained auxiliary personnel under the direction of a physician or other practitioner, which may include a patient navigator or certified peer specialist; 60 minutes per calendar month, in the following activities … | $79.24 |

| G0024 | Principal Illness Navigation services, additional 30 minutes per calendar month | $49.44 |

Social workers, community health workers (CHWs), and other staff who furnish CHI services that address social needs identified during an E/M visit or annual wellness visit must be certified or trained to deliver them, and those services would be performed incident to the billing physician/practitioner. A clinician may also arrange for CHI services through an externally contracted organization, such as a community-based organization that employs CHWs (assuming clinical integration between both parties).

PIN services may be initiated at an E/M visit to address a condition that places the patient at high risk for hospitalization, acute decompensation, or other serious decline and requires frequent monitoring and adjustment of a disease plan or treatment regimen, or assistance from a caregiver. CMS says PIN services are like CHI services, except they are provided to beneficiaries who may not have social determinants of health (SDOH) needs but have needs specific to their disease or condition.

SDOH health risk assessment. CMS is adding an optional SDOH risk assessment to the Medicare annual wellness visit (AWV). To be eligible for an additional payment, practices must deliver the SDOH risk assessment on the same day as the AWV using a standardized, evidence-based tool that is culturally and linguistically appropriate and aligns with the beneficiary’s educational, developmental, and health literacy needs. CMS does not mandate the use of any specific tool. CMS has established a standalone G code (G0136) for SDOH risk assessment when it is furnished in conjunction with an E/M visit or Medicare AWV. The assessment can be performed once every six months, per practitioner, per beneficiary. When performed during an AWV, Medicare pays 100% of G0136, with no cost-sharing to beneficiaries. Medicare allows $18.66 for the new code.

CPT CODING UPDATES

As always, there are changes to CPT coding in the new year. The ones likely to affect family physicians the most are related to E/M services, where CPT altered some codes, introduced an add-on code, and revised some guidelines and descriptions.

New add-on code for pelvic exams. CPT added code +99459 for “Pelvic examination (list separately in addition to code for primary procedure)” to account for practice expenses associated with performing exams. Specifically, the code is intended to capture the expense of having clinical staff "chaperone" these exams (but chaperoning is not a requirement for billing). You may report the code in conjunction with new and established patient office and other outpatient codes (99202-99215), preventive medicine codes (99383-99387 and 99393-99397), and office or other outpatient consultation codes (99242-99245). Practices should create alerts in their electronic health record (EHR) for the above E/M codes that remind them to also report 99459 when appropriate. Because 99459 is an add-on code, a modifier is not required.

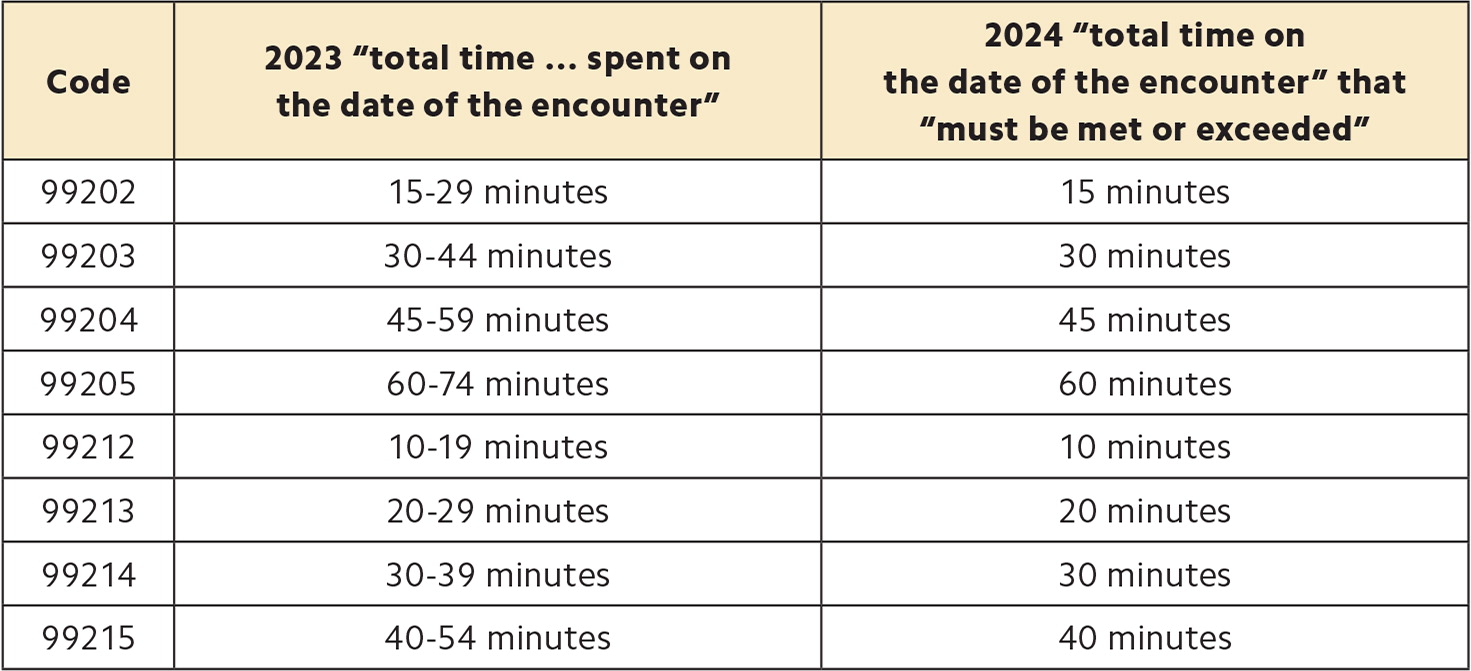

Time-based coding changes. To be consistent with Medicare, CPT changed the descriptors for codes 99202-99215 to replace ranges of time for each level of service with minimum times that must be met or exceeded. The change does not impact how practices report a level of E/M service when selecting codes based on total time. (See “E/M outpatient, nursing facility, and hospital time-based coding changes.”)

E/M OUTPATIENT, NURSING FACILITY, AND HOSPITAL TIME-BASED CODING CHANGES

| Code | 2023 “total time … spent on the date of the encounter” | 2024 “total time on the date of the encounter” that “must be met or exceeded” |

|---|---|---|

| 99202 | 15–29 minutes | 15 minutes |

| 99203 | 30–44 minutes | 30 minutes |

| 99204 | 45–59 minutes | 45 minutes |

| 99205 | 60–74 minutes | 60 minutes |

| 99212 | 10–19 minutes | 10 minutes |

| 99213 | 20–29 minutes | 20 minutes |

| 99214 | 30–39 minutes | 30 minutes |

| 99215 | 40–54 minutes | 40 minutes |

| Code | 2023 times | 2024 times |

|---|---|---|

| 99306 | 45 minutes | 50 minutes |

| 99308 | 15 minutes | 20 minutes |

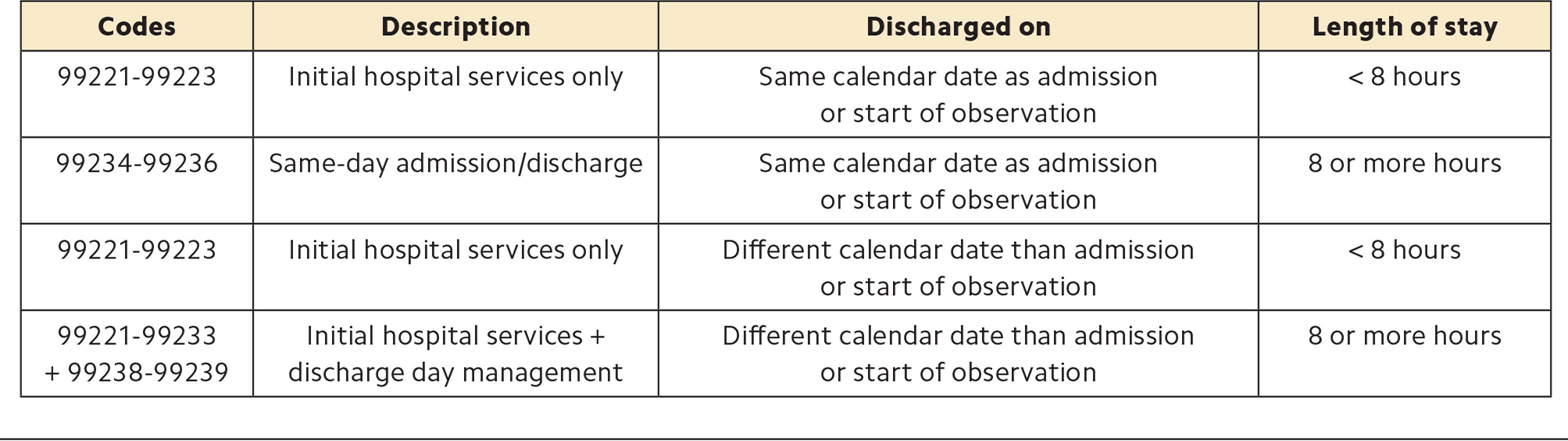

| Codes | Description | Discharged on | Length of stay |

|---|---|---|---|

| 99221-99223 | Initial hospital services only | Same calendar date as admission or start of observation | < 8 hours |

| 99234-99236 | Same-day admission/discharge | Same calendar date as admission or start of observation | 8 or more hours |

| 99221-99223 | Initial hospital services only | Different calendar date than admission or start of observation | < 8 hours |

| 99221-99233 + 99238-99239 | Initial hospital services + discharge day management | Different calendar date than admission or start of observation | 8 or more hours |

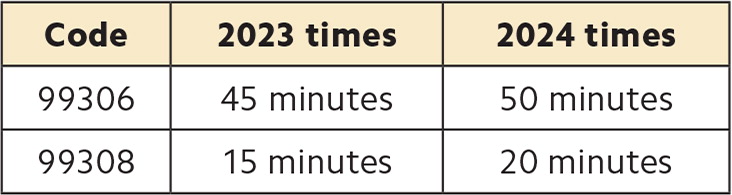

CPT also changed the requirements for two nursing facility care codes (99306 and 99308), increasing the threshold times for both by five minutes. Practices only need to update any EHR macros used to attest total time for the two codes.

CPT revised its guidelines for hospital inpatient and observation E/M codes, adding a specific time element to codes for reporting admission and discharge services on the same date of service. The revisions clarify that codes 99234-99236 are only reported when the length of stay is more than eight hours and the same physician or other QHP performs both the initial hospital inpatient or observation care and discharge services. Again, CPT made this change to align with CMS policy.

The same-day admission and discharge codes require at least two visits on the same date: an admission visit and a discharge service. Physicians should make sure the time in the clinical record supports coding for same-day admission and discharge services and that they document two distinct clinical notes. Practice staff involved in charge capture and coding for hospital-based services should be made aware of the revised requirements.

Cognitive assessment and care plan services with prolonged services. CPT revised its introductory guidelines for prolonged services codes 99417 and 99418 to clarify that cognitive assessment and care plan services (code 99483) does not have a required time threshold, but the typical time is 60 minutes. Physicians and other QHPs may report 99417 when they exceed the typical time by 15 minutes.

Other E/M guideline revisions. In addition to the above revisions, CPT made a grab bag of changes to other E/M sections.

CPT expanded the guidelines for code selection when reporting split or shared visits — team-based care in which a physician and a QHP (e.g., advanced practice nurse or physician assistant) both provide care on the same day, as follows:

When they use total time, the one who provides the majority of time should report the service,

When they use medical decision making (MDM), the one who made or approved the plan of care and assumed the responsibility for that plan and its risks should report the service.

CPT also added a new section to address the reporting of multiple E/M services on the same day by physicians and QHPs in a group practice. The instructions address the following:

Multiple services in the same setting or facility,

Multiple services in different settings or facilities,

Emergency department (ED) services and services in other settings,

Discharge and readmission to the same facility,

Discharge from one facility and admission to another facility,

Critical care services with other E/M services,

Transition between outpatient, home, or ED and hospital inpatient and observation care services or nursing facility services.

Physicians and practice staff should review the revised E/M guidelines to ensure billing and coding practices are in line with them.

Vaccines and immunoglobulins. CPT created two new codes (90380 for 0.5 mL dose and 90381 for 1.0 mL dose) to report immunoglobulin products for seasonal immunization against respiratory disease caused by respiratory syncytial virus (RSV). CPT also approved two new administration codes (96380 for administration with counseling and 96381 for administration without counseling) to be used only in conjunction with these product codes.

CPT has added several additional vaccine product codes, including 90611 and 90622 for monkeypox and smallpox vaccines (the codes were released in 2022 but not added to the CPT manual until 2023).

CPT also overhauled the codes and instructions for reporting COVID-19 vaccines in September to reflect new Centers for Disease Control and Prevention guidelines following the release of shots reformulated to target new variants. (A full explanation of those changes is available in the FPM Getting Paid blog).6

New vaccines/toxoids/immunoglobulin products are updated on the American Medical Association website each year on Jan. 1 and July 1. Physicians and practice staff should review the guidelines and instructions and make the appropriate additions and changes in the EHR and other charge capture documents.

MEDICARE QUALITY PAYMENT PROGRAM CHANGES

As in previous years, CMS made updates to the Quality Payment Program (QPP). Notable changes include the following:

Increasing the quality performance category data completeness threshold to 75%,

Adding new episode-based cost measures, including three for chronic conditions that may impact family physicians: depression, heart failure, and low back pain,

Increasing the performance period for the promoting interoperability category from a minimum of 90 continuous days to 180 continuous days,

Requiring practices to attest “yes” to the Safety Assurance Factors for Electronic Health Record Resilience (SAFER) Guides measure. CMS previously allowed practices to submit a “yes/no” response. To satisfy the measure, practices need to affirm they conducted an annual self-assessment of the High Priority Practices Guide within SAFER. Failure to complete it results in zero points for the entire promoting interoperability category.

CMS did not change the performance threshold, which will remain at 75 points.

Medicare continues to refine the Merit-based Incentive Payment System (MIPS) Value Pathways (MVPs). For the 2024 performance year, CMS is creating five new MVPs, including one focused on women’s health and one related to mental health and substance use disorders. It’s also consolidating the “Promoting Wellness” and “Optimizing Chronic Disease Management” MVPs into one called “Value in Primary Care.”

CMS made more sizable updates on the alternative payment model side. Medicare Shared Savings Program participants have a new collection type available — Medicare Clinical Quality Measures (CQMs). Medicare CQMs allow accountable care organizations (ACOs) to report data on their Medicare fee-for-service beneficiaries only, instead of their all payer/all patient population.

While these are not major changes to the QPP, there are still a few things practices can do for the 2024 performance year:

Review the available MVPs. Practices have until Nov. 30 to register to report an MVP, but it’s worthwhile to decide early so you can ensure you have processes in place to collect the right data. You can review MVP measures and activities on the QPP website.

If you plan to report the same measures as in previous years, take a minute to check out the quality measure and improvement activities inventories. Verify that your preferred measures are still available and their requirements have not changed.

Download and review the High Priority Practices SAFER Guide.

If you are part of a health system or participate in an ACO, talk with your administration to understand if and how any of these changes impact your workflows.

JUST A SUMMARY

As always, these are not all the changes to Medicare payment, CPT coding, and the QPP that the new year brings. But armed with this summary, family physicians should be better able to move forward confidently in 2024.