Knowing the rules can help practices receive payments that better reflect the work of the whole health care team.

Fam Pract Manag. 2024;31(3):9-14

Author disclosure: no relevant financial relationships.

Medical services are usually billed by the individual who performs the service. However, Medicare has two exceptions — “incident to” and “shared services.” These two rules essentially allow physicians to bill for care provided by clinicians and staff who work with them as if the physicians had done it themselves. They're similar rules, but with key differences.

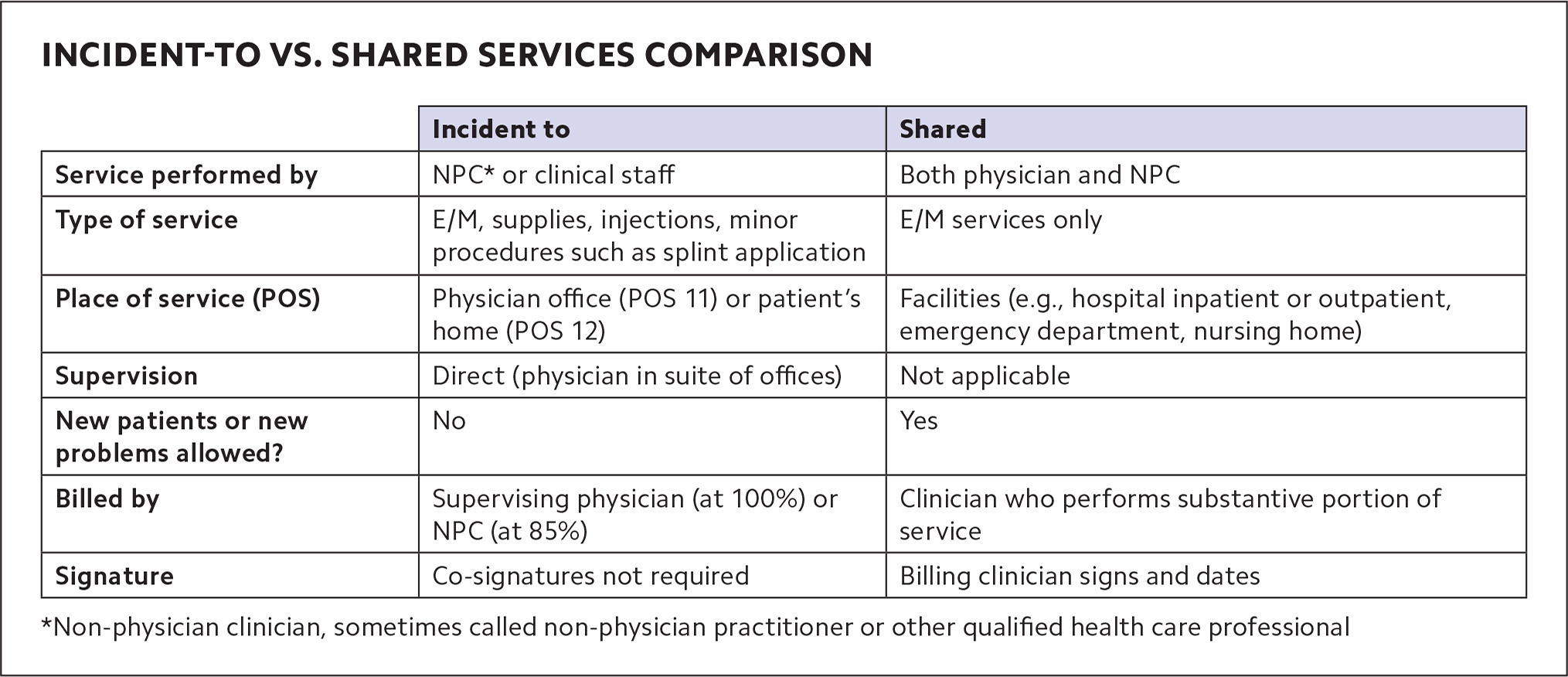

Incident-to services are performed in physician offices or patients' homes, while shared services are performed in facilities such as hospitals or nursing homes. Incident-to services can be performed by either non-physician clinicians (NPCs) or clinical staff as part of the billing physician's professional services, while shared services must be performed by two clinicians (physicians or NPCs) who each could have billed the service on their own. (See “Incident-to vs. shared services comparison.”)

In either case, though, if the physician is billing, Medicare pays the full physician fee schedule rate, while services billed by NPCs are paid at 85% of that. Some private insurers also allow incident-to billing and shared services billing under rules similar to Medicare's, but this varies by payer.

Shared services rules have changed recently, as CPT has published new definitions (which Medicare has largely adopted, for now). The requirements for incident-to billing haven't changed, but they can be confusing, and because family physicians tend to use incident-to billing more often, a refresher is useful. This article provides that refresher on incident-to billing, as well as an explanation of the changes to shared services billing, and has a set of questions and answers with specific scenarios to help physicians understand when and how to use each of them.

KEY POINTS

Medicare allows supervising physicians to bill for services that other members of the health care team provide in office or home settings (“incident-to” billing) and bill for services they provide jointly with other clinicians in facility settings (“shared services”).

Some private payers also allow incident-to billing and shared services billing, and CPT has released definitions for shared services.

Shared services are billed by the physician or other clinician who performed the “substantive portion” of the E/M visit, which is easier to determine when using total time.

INCIDENT-TO REFRESHER

Incident-to rules allow a supervising physician to report services performed by NPCs or auxiliary clinical staff as if the physician personally provided them. NPCs are most often physician assistants or nurse practitioners. They're sometimes called “other qualified health care professionals” (QHPs)” or “non-physician practitioners” (NPPs), but in this article we'll refer to them as NPCs. Clinical staff are most often medical assistants or nurses, but could include other professionals who work under physicians' supervision (see “Definitions”). Billing for incident-to services under the supervising physician's name and National Provider Identifier (NPI) results in the full reimbursement rate.

DEFINITIONS

Non-physician clinicians (NPCs) or non-physician practitioners (NPPs): Physician assistants and a variety of advance practice registered nurses (e.g., clinical nurse specialists, certified nurse midwives, nurse practitioners, and certified registered nurse anesthetists) who are allowed to bill Medicare directly.

Other qualified health care professional: According to CPT, “A physician or other qualified health care professional is an individual who by education, training, licensure/regulation, and facility privileging (when applicable) performs a professional service within his/her scope of practice and independently reports a professional service. These professionals are distinct from clinical staff.” This includes the NPCs/NPPs above, but also other professionals such as physical therapists and clinical social workers.

Clinical staff member: According to CPT, this is “a person who works under the supervision of a physician or other qualified health care professional and who is allowed by law, regulation, and facility policy to perform or assist in the performance of a specified professional service.” This includes medical assistants and nurses.

NPCs may also use incident-to billing for services clinical staff provide under their supervision. As noted, though, Medicare will pay a lesser rate (85% of the physician fee schedule amount) for incident-to services billed using the NPC's name and NPI on the claim form.

Incident-to services include evaluation and management (E/M) and other services and supplies commonly furnished in medical practices, such as applying a splint, doing an injection, or checking blood pressure at a nurse visit. Incident-to billing does not apply to services with their own statutory benefit categories (i.e., groups of services health plans are legally required to cover), including wellness visits, clinical diagnostic tests, and pneumococcal, influenza, and hepatitis B vaccines.

To bill for a service that an NPC performed under the physician's NPI (at the full physician rate), these requirements must be met:

• The service must be part of a physician's plan of care. The physician sees the patient at a prior encounter and establishes the plan of care. After that, the NPC may see the patient as part of the physician's treatment. (If a subsequent E/M service can be performed entirely by clinical staff, rather than an NPC, the supervising physician may still bill for it as an incident-to service at the full physician rate using E/M code 99211 — the lowest level of E/M. Higher level E/M services must be performed by an NPC or physician.) E/M services for new patients, or new problems for existing patients, aren't eligible for incident-to billing because they are not part of the physician's preexisting plan of care. If an NPC provides these services, they must bill for them under their own NPI (at the 85% rate).

• The service requires direct supervision. The physician, or the physician's covering partner, is in the suite of offices (or patient's home) and immediately able to assist if needed when the NPC performs the service. Medicare rules are generally interpreted as requiring the supervising physician to be in the same or a similar specialty as the NPC performing the service, although the Centers for Medicare & Medicaid Services (CMS) doesn't specifically say this. Likewise, CMS does not specifically define supervision beyond the physician being “in the suite of offices,” but some payers interpret it to mean not separated by a set of stairs or elevator.

• The NPC must be an expense to the practice, either employed, leased, or contracted.

• The physician must stay involved in the plan of care, but CMS does not describe exactly what this entails. It could mean alternating visits with the NPC or periodically seeing the patient. Simply signing off on the record alone is less compelling as documentation, and there is no Medicare requirement for co-signature. NPCs can provide documentation that supports incident-to billing by noting in their assessment that the visit was part of the physician's plan of care and that the physician was in the office. But CMS does not specifically require this.

• The NPC must be enrolled in Medicare, whether billing directly or incident to the physician, according to U.S. Department of Health and Human Services guidance.1

SHARED SERVICES

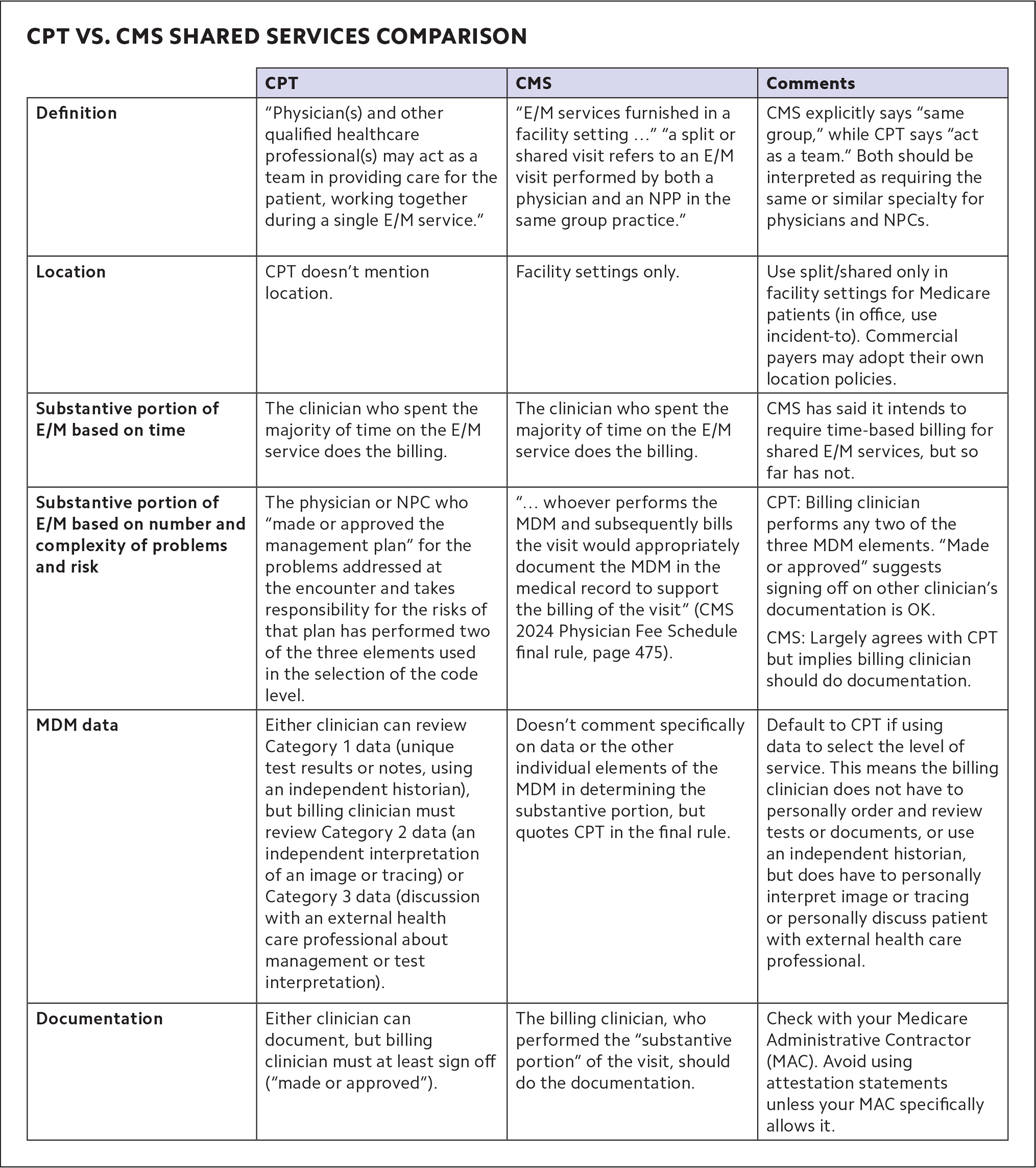

Until recently, only Medicare defined shared services. But CPT added its own definition in 2021 and expanded it in 2024. (See “CPT vs. CMS shared services comparison.")

Shared services are E/M services that a physician and NPC perform jointly in a facility setting, such as inpatient and outpatient hospital buildings, emergency departments, and nursing homes. Shared services may not be performed in physician offices that are not part of a facility setting. The place of service (POS) code is key to shared services billing.2 For example, hospital outpatient clinics that use POS 19 (on campus) or 22 (off campus) can bill for shared services, whereas physicians' offices that use POS 11 cannot. (It's the opposite with incident-to services, which can be billed with POS 11, but not POS 19 or 22.)

Both clinicians must be enrolled in Medicare and able to perform E/M services on their own (a physician may not share E/M services with a social worker or dietitian, for example, because those professionals don't have E/M in their scope of practice).3

To bill for E/M as a shared service, both clinicians must participate in the patient's care on the same calendar day. The identity of both clinicians must be included in the encounter note, but only the billing clinician is required to sign and date the medical record. That clinician then submits the claim using HCPCS modifier FS (“split [or shared] evaluation and management visit”) for Medicare.

Remember that when the physician bills for the shared service, Medicare pays 100% of the physician fee schedule allowance, but when an NPC bills, it results in payment of only 85%. So, it makes sense to bill under the physician's NPI when possible. But under both Medicare and CPT rules, physicians may only do this if they perform the “substantive portion” of the service.

Billing based on time. If you're billing for E/M based on total time, determining who provided the substantive portion of the visit is pretty straightforward: The clinician who accounted for more than half the visit's total time (face-to-face and non-face-to-face time combined) performed the substantive portion of the service. Thus, both clinicians should document their own time, and if the physician's time is greater than half, the service should be billed under the physician's NPI. The only complicating factor with time-based coding is that if the physician and other clinician meet to discuss the patient, or see the patient together, only one of them can count those minutes — they can't double-count them.

Billing based on MDM. If you're using medical decision making (MDM) to code an E/M service, determining who performed the substantive portion is significantly more complicated. There's no quick and clear way to do it, but here is some guidance based on both CPT and CMS rules.

MDM is defined by three elements: the number and complexity of problems addressed, the amount and/or complexity of data reviewed and analyzed, and the risk of morbidity and/or mortality from additional diagnostic testing or treatment. In 2024, CPT added this instruction: “performance of a substantive part of the MDM requires that the physician(s) or other QHP(s) who made or approved the management plan for the number and complexity of problems addressed at the encounter take responsibility for that plan with its inherent risk of complications and/or morbidity or mortality of patient management. By doing so, a physician or other QHP has performed two of the three elements used in the selection of the code level based on MDM. If a practice codes the visit based on medical decision-making (MDM), the practitioner who performs the problems addressed and risk portions of the visit reports the service.”4

The key takeaways are this:

The physician or NPC who evaluates the problems and determines and takes on the risk of the additional testing and treatment of those problems (two of the three MDM elements) meets the “substantive portion” threshold to qualify as the billing clinician.

CPT states that the billing clinician “made or approved the management plan.” It does not state that the billing clinician must personally document the plan.

There is one twist. If you use data to select the level of E/M service and include Category 2 data (an independent interpretation of an image or tracing) or Category 3 data (discussion with an external health care professional about management or test interpretation), the billing clinician must perform that portion of the service.4 Category 1 data (ordering and/or reviewing unique test results, reviewing notes, or using an independent historian) does not need to be performed by the billing clinician because this work is included in the formulation of the diagnosis and plan.

Because of the complicated nature of determining who should be the billing clinician using MDM, CMS has said that in the future it intends to require that clinicians only use time to determine who performed the substantive portion of shared services. But CMS delayed that change for the third year in a row in its 2024 Physician Fee Schedule final rule, instead saying it would follow the new CPT definition for now.

CMS also said this about shared services: “Although we continue to believe there can be instances where MDM is not easily attributed to a single physician or NPP when the work is shared, we expect that whoever performs the MDM and subsequently bills the visit would appropriately document the MDM in the medical record to support the billing of the visit.”5

CMS does not explicitly say what the billing physician needs to document and what the NPP (or NPC) could document instead. Therefore, although CPT's guidance seems to indicate that an attestation statement is acceptable (“made or approved the management plan”), it would be prudent for physicians to personally document MDM when billing Medicare for shared services under their NPI.

PAYMENTS THAT BETTER REFLECT THE WHOLE HEALTH CARE TEAM

Clearly, the rules governing incident-to billing and shared services billing are not always simple. But the list of questions and answers should help clarify some common scenarios.

Having a basic understanding of when shared services and incident-to rules apply allows physicians to receive payments that better reflect the actual work their practices are doing, especially as team-based care increases.

Q&A

Q: Dr. Taylor sees a patient for hypertension and sets a plan for the patient to return to see the nurse practitioner (NP) to titrate the medication in two weeks. When the patient comes back to see the NP, Dr. Taylor is out of the office, but her partner Dr. Jackson is in the office. Do we bill this latest visit under Dr. Taylor or Dr. Jackson?

A: Dr. Jackson. Bill under the supervising physician who is in the office and able to provide assistance if needed.

Q: A physician sees an established patient for an acute problem, a sprained ankle. Six months later, the patient slips and re-sprains the ankle and the practice's physician assistant (PA) sees the patient. Can the physician bill this as an incident-to service?

A: No, this acute condition is a new problem and should be billed by the PA.

Q: Can you bill incident to if using time to determine the level of evaluation and management?

A: Yes. You can bill incident to if using time or medical decision making.

Q: If a physician and an advance practice registered nurse (APRN) are billing for a shared service E/M visit based on time, do each of them need to document their time?

A: Yes. The clinician who accounted for more than 50% of the time bills for the service, so both the physician and the APRN must document their time. (They can't double-count time if they both see the patient together or meet to discuss the patient.)

Q: Working in an outpatient hospital department, a physician and PA each perform part of an office/other outpatient visit. It is follow up for an urgent care visit over the weekend. The patient has an acute, uncomplicated condition, and a prescription medicine is given for cough control. The physician personally interprets the chest x-ray from the urgent care visit. Under the shared services rules, who should report the E/M service and what is the correct level of service?

A: Two of the three medical decision-making elements are moderate: amount and complexity of data (independent interpretation) and risk (prescription drug management). It is, therefore, a level-4 E/M visit. The physician performed the independent interpretation of data and, therefore, may bill for the visit.

Q: Can we bill for shared services for nursing facility visits?

A: Yes. Skilled nursing visits that use place of service 31 qualify because that is considered a facility location. But nursing facility services in place of service 32 (mostly rehab providers) do not because that is considered a non-facility location. Also, shared services may not be performed for visits mandated to be done by a physician.